The AURA PDF is a report that automates the review process by providing insightful data and results based on the appraisal uploaded. We provide ClearQC® rules, ClearCollateral® accuracy and quality scores, and a ClearComp grid to assist with and streamline the underwriting process.

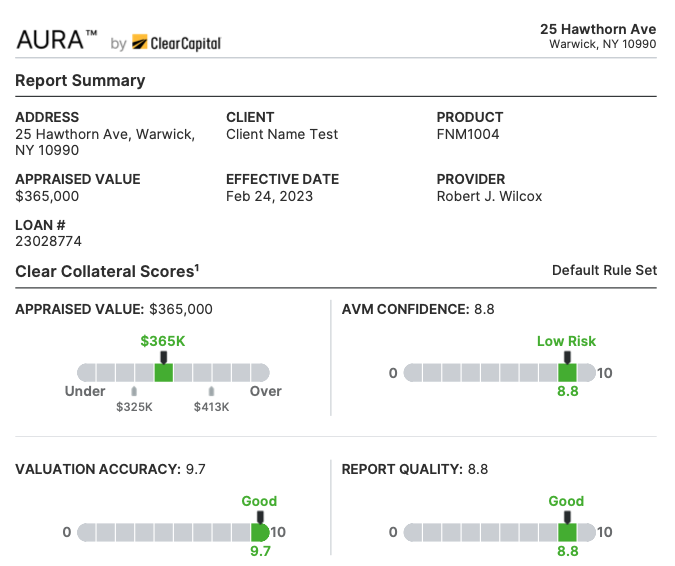

ClearCollateral Scores

We provide a series of scores on each appraisal that help determine the valuation accuracy.

-

- Appraisal Value: We display our supportable value range for the property based on data from our ClearAVM. This chart provides a quick understanding if there is risk of over- or under-valuation.

- AVM Confidence Score: A score based on the amount and quality of data we have to determine the supportable value range. The more quality data we have for a property, the higher our confidence.

- Valuation Accuracy Score: A score representation of the appraised value in comparison to our supportable value range. The closer to center the appraised value sits within the supportable value range, the higher the score. The lower the score, the higher risk for over- or under-valuation.

- Report Quality Score: A score that represents the ClearQC rule findings. We start with a score of ten and subtract the weights of any rules that fail.

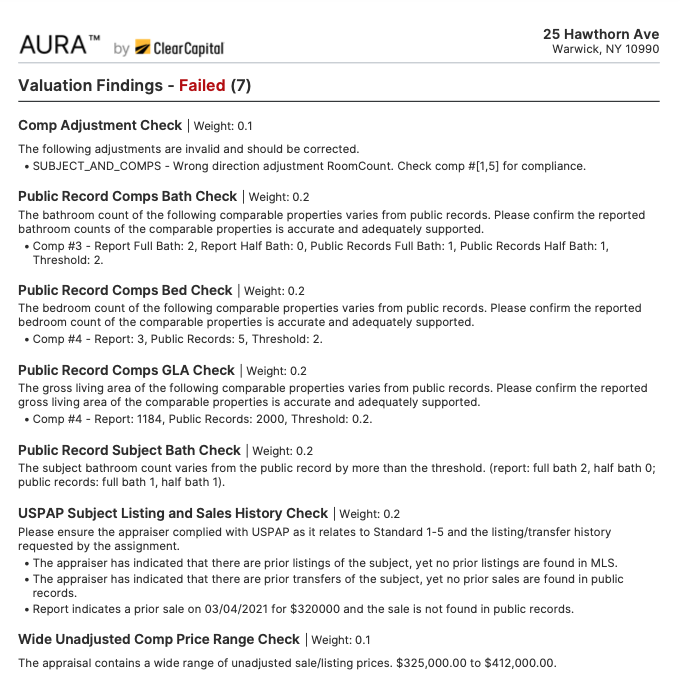

ClearQC

ClearQC is a rule-based tool that runs 89 rules on every appraisal using information from the appraisal, comparables, market analysis, public records, local market insights, etc. in order to provide automated feedback on an appraisal.

Data sources used in ClearQC Rules are:

- Valuation data and photos (appraisal XML)

- Order data

- Public records

- Local market insights

- ASC.gov

- ClearComps/ClearRank

- Home Data Index (HDI®)

- ClearAVM

- Historical reports

ClearQC automates a large part of the review process and provides feedback on whether the appraisal/order should be approved, revised, or declined.

Of the 89 rules that run on every appraisal, ClearQC checks for completeness and consistency, valuation accuracy, photo discrepancies, and more. ClearQC contains 14 rules that use our proprietary PhotoAI technology that can detect any discrepancies between the appraisal, photos, and sketch as well as identify the condition rating of the property.

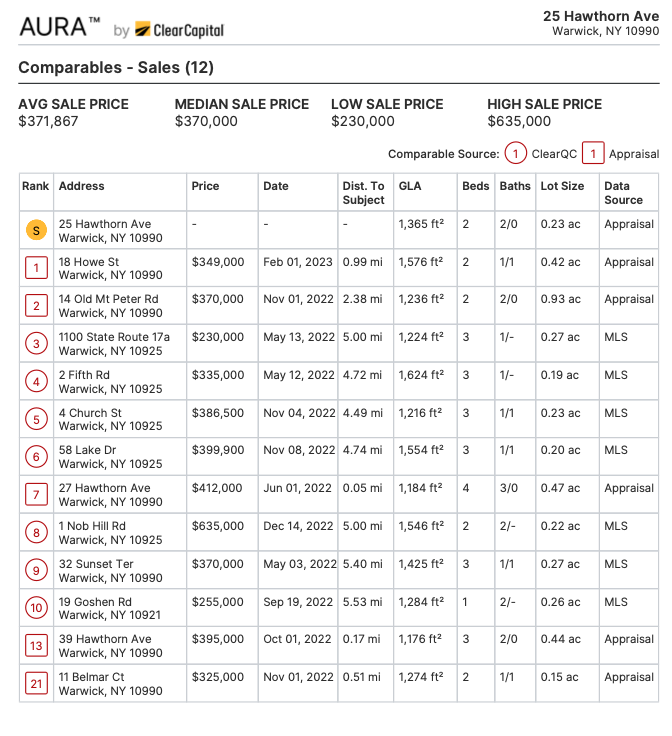

Comparables

We supply a comp grid that provides a list of ranked comparables from local market insights and compares those to the report-supplied comparables in order to flag any issues with the sales comparison approach.

We provide two different grids, one for sales and the other for listings so the reviewer can get a full picture of how the sales comparison approach was completed and if different comparables need to be selected in order to better support the property value.

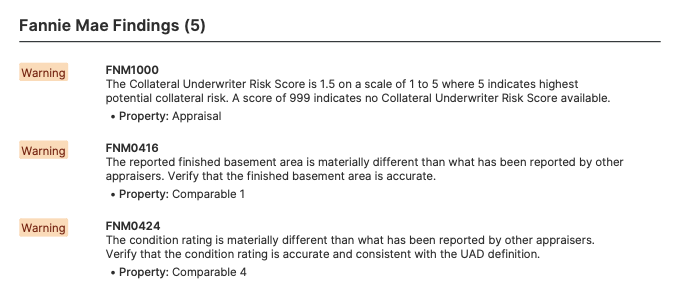

UCDP/EAD Scores and Findings

We provide the ability to submit to UCDP/EAD on your behalf. With this service, you will receive the Collateral Underwriter (CU) and Loan Collateral Advisor (LCA) scores as well as CU, LCA, and FHA findings within the AURA PDF so you do not have to spend time manually submitting to UCDP/EAD and combing through Submission Summary Reports (SSRs).

To set up AURA to submit to UCDP/EAD on your behalf, please contact our support team.